SBI PO Study Plan 2018

Hello students as you all know

SBI has released the official notification for SBI

PO recruitment 2018 and exam dates of SBI PO 2018 are already

out and you all must have already started your preparations for the SBI PO Examination

2018. As the preliminary examination of SBI PO 2018 is going to take place

in July so it is the crucial time to put your all efforts to crack this exam as

the competition is going to be really hard-hitting. Candidates you still have

two months for the preparations so don’t lose your hope; have a positive

attitude and work hard to hit your goals. For helping you out in this crucial

time we are providing you a study plan which is a weekly based study plan and

is going to help you in scheduling and managing your time.

As in any exam there are different requirements for the different

sections because there are some topics which require more time and some topics

are those which want less time so we have to plan our time table according to

these topics. As we have not extra time to waste on the unnecessary things so it’s

better to well plan your schedule and study according to this.

So in this article we are

providing you a study plan which is a weekly based study plan and this will

help you in dividing your topics weekly wise and to prepare them according to

the time they required. So you have no need to look here and there just do not

waste your time, adhere to the study plan and you will surely be able to

achieve your goals. This plan is prepared as a result of analysis of SBI

PO 2016 and 2017 examinations.

Study Plan for SBI PO 2018

WEEK

|

REASONING

|

QUANT APTITUDE

|

ENGLISH

|

First Week

|

Distribution/ Comparison based Puzzles(2-3 Variables),

Direction and Distance, Order and Ranking, Blood Relations |

DI (Bar Graph, Pie Chart), Number Series,

Simplification, Approximation

Quadratic Equations, Percentage, Ratio and Proportion, Partnership |

Reading Comprehension, Cloze Test, Error Detection,

Sentence Improvement, Idioms and Phrases

|

Second

Week

|

Box and Floor Puzzles (1-2 Variables), Coding-Decoding,

Data Sufficiency

|

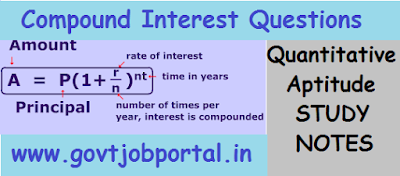

DI (Line Graph, Tabular), Number Series,

Simplification, Approximation

Quadratic Equations, SI and CI, Average, Time, speed and distance |

Reading Comprehension, Cloze Test, Error Detection,

Sentence Completion

|

Third

Week

|

Linear Arrangement(Direction- Same/Opposite,

North/South; 1-2 Variables), Syllogisms

|

DI (Caselet, Bar Graph+ Tabular), Number Series,

Simplification, Approximation

Quadratic Equations, Mixture and Alligation, Time and Work, Pipes and Cisterns |

Reading Comprehension, Cloze Test, Error Detection,

Fillers(Single/Double)

|

Fourth

Week

|

Circular/Square/Rectangular Arrangements(Direction-Inward/Outward;

1-2 Variables), Machine Input-Output, Inequalities

|

DI (Bar Graph + tabular, Pie Chart + Tabular, Line

Graph + Tabular), Number Series, Simplification, Approximation

Quadratic Equations, Problems On Age, Problems On Trains, |

Reading Comprehension, Cloze Test, Error Detection,

Sentence Rearrangement

|

Fifth

Week

|

Mixed Puzzles, Alpha Numeric Sequences, Critical

Reasoning

|

DI (Bar Graph, Pie Chart), Number Series,

Simplification, Approximation

Quadratic Equations, Boat and Stream, Permutation and Combination, Probability |

Reading Comprehension, Cloze Test, Error Detection,

Sentence Connectors

|

6th & 7th

Week

|

Mock Test

|

Mock Test

|

Mock Test

|

As you all have

prepared according to the study plan, now it is the time for evaluation. Self

evaluation is very important; if you will self evaluate yourself then only you

will come to know your weak as well the strong points. Last 10 to 15 days are

very crucial, in this period you should evaluate yourself by solving the

previous year question papers and give a final touch to every topic, because if

you will not give a review to the learnt topics then they will be washed away

because most of the topics which you have not given a review fades away with

the time. So it is good to give a fresh look to every topic and work on your

weak points and strengthen your strong points.

In these crucial days just go through the SWOT Analysis.

SWOT stands for (Strength, Weaknesses, Opportunities, and Threats). This will

help you in building your self confidence which is a key to get the success in

any field. Let us explain this strategy in brief.

S stands for

Strengths: go through the topics and evaluate yourself that in which

topics you have a strong hand and prepare them well and make them an instrument

for the fight. Learn these topics on

your fingers so that you can attempt such type of questions in the exam with

full accuracy. In simple words you can say just work on your strengths.

W stands for

Weaknesses: work on the topics, in which you are weak, practice them

more frequently and try to improve your command on these topics.

O stands for Opportunities:

utilize the opportunities at a right time, this means that the topics in which

you have a strong hand try to attempt those in the exam with more accuracy and

in less time. This will help in saving your time for the other questions.

T stands for Threats:

this means to say that stay away from the threats such as the negative marking

threat. Focus on the quality of the answered questions not on the quantity. Try to attempt the maximum questions

with accuracy. Leave the questions in which you have any doubt. Attempting the

doubtful questions can ruin your dream of becoming a banker.

Use these all

strategies to achieve your goals. Best of luck students!!!